👋🏼 Hey founder, are you fundraising for your early-stage startup? I’m giving you a head start.

Fundraising is both art and science. There’s a certain practice that you can familiarise yourself with and as a result, avoid common pitfalls that could discredit your startup.

So here are some of the resources that might become handy when raising your Pre-Seed / Seed (and even Series A) round.

EARLY-STAGE Fundraising prep

Before you fundraise you should keep the below in mind.

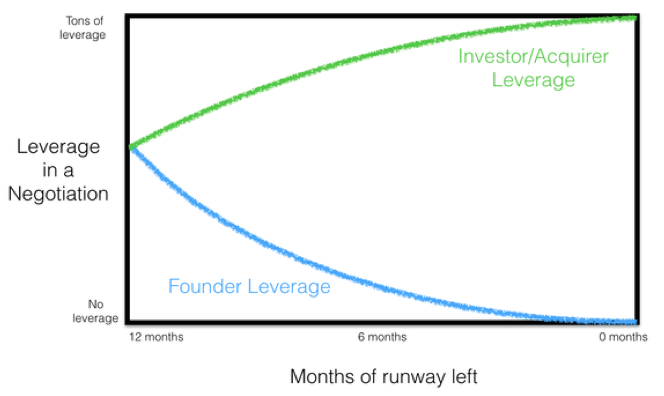

Fundraising is most often not a 1-2 month sprint, especially in the current market conditions. You should estimate at least 6 months for the process so start reaching out early.

Your runway can either work for you or against you (graph below). Investors smell desperation: no runway = no leverage. And just like dating, you don’t want to come across desperate on your first date. So planning ahead is key.

Tools for fundraising

- Pitch deck

- Fundraising CRM

- Investor pipeline

- Forwardable intro

- Dataroom

📌 PITCH DECKS

There are a lot of resources available to help you guide through pitch decks. Use them. Again, there are certain slides and information that is expected to be presented in your deck. This information should be presented in a concise manner that makes sense on its own, without having to present alongside. There’s little point to attach large reports or articles alongside the deck – most of the time we don’t have time to go through it all. And if it’s important, it should be in the deck. If you have existing investors, use them for feedback or find some founders who can help you.

As a starting point, read these:

- Seed deck template by Creandum

- Pitch deck template by Inventure

- Pitchdeck template by DocSend and guidance on putting decks together

PS! Design matters! Especially if your pitchdeck is the first impression you leave. So invest in design or use templates by Canva / Pitch. I’m sure you’ve experienced great UX and this made your experience much more enjoyable. The same with pitch decks.

Superangel receives tens of cold inbound requests a week from startups that we’ve never met before. Having a well formulated and coherent deck can really help us make a decision if we should proceed with the deal.

✅ Quick DOs:

- Use titles to tell a story and deliver takeaways. If you write “Market” on a slide that clearly talks about the market, you’ve just wasted important space to convey a message.

- Make it mobile friendly. No small text / crowded slides.

- Think how you present your team. Team is number one priority in early-stage investments. But pictures and titles say little of why your team is the right one to address this problem. Don’t be modest and show how your experience matters.

❌ Quick DON’Ts

- State your valuation. Unless it’s determined by the lead investor of this round. Otherwise, you just shoot yourself in the foot by either proposing something way too high or even worse, too low.

- Use clients logos who are not your clients – it’s easy to check

- Not necessarily related to pitch decks, but be careful when you name drop all the investors you’re speaking to. It’s obvious if you try to create FOMO. And if none of these awesome investors end up investing then you’ve undermined your own strategy.

- Set fake deadlines. If you’re closing the round because it’s oversubscribed and you need to move, then yes, communicate deadlines. But if you’re just doing it to make investors move faster, it doesn’t work. We like to get to know the founders and do our DD properly so if we can’t make the deadline, we have to give this opportunity up.

FUNDRAISING CRM

Putting together your next round means you are likely to speak to 50-100 funds (yes, that many), with an exception of an angel / pre-seed round.

Just like managing your client pipeline, managing the investor pipeline can make the process a lot more structured. Plus you’re able to easily share it with your current investors who can help you with intros.

You can consider the following tools to help with pipeline management (example stages Pipeline, Outreach done, Connection established, In process, DD)

- Excel

- Your existing CRM (e.g. Pipedrive)

INVESTOR PIPELINE

Once you understand how investors choose their investment prospects (which is strongly linked to their strategy), you’re more likely to approach and reach relevant investors. If you take this seriously, a must read to understand how investors think is Secrets of Sand Hill Road: Venture Capital and How to Get It.

TLDR: We also have investors (limited partners) who have backed our fund based on a certain strategy. In most cases, VCs have clear geographical, sector, and stage focus. That means, we can’t go out there and invest into whatever lands on our table. As an example, if you’re a hardware company, you should not be surprised that you got a negative response from an investor that only does software. Therefore, understanding if your company matches the strategy of the fund, should be your first priority before spending more time with them.

Here’s a list of resources of VC lists and their strategies

- 100+ VCs investing into the Baltics (& Excel)

- Open VC database of 5000+ investors

- A major list of global deeptech investors by Hello Tomorrow

- 29 European deeptech investors by Sifted

- Climate investors

- VCs and angels investing into female founders by GoBeyond Capital

- A list of 250+ active female angels by Sifted

- A list of female VC partners by Sifted

- Most active angel investors in Estonia

- Finding angel investors in Lithuania

Please bear in mind that these databases might not be regularly updated but are a great starting point.

FORWARDABLE EMAIL: Make it easy for others to do warm intros for youtive Heading

Warm intros are by far the best way to get your foot through the door. Your job is to 1) find the people that can open doors for you (LinkedIn connections are the first obvious place to start with) and 2) make it as easy for the investor to forward the information. After all, they’re spending their credit to help you.

This template on how to ask for VC intros by Raimonds Kulbergs should be a mandatory item in your toolset. It’s one of the resources I share the most.

The more facts and clear metrics you can share, the better. Generic intros don’t tend convert as much.

📌 DATA ROOM

When investors get more serious in investing in your startup, they start asking for more information, which is standard. Have them ready to make the process move faster.

The detail level of the data room depends on the stage you’re fundraising for. Generally, the earlier you are, the less data you have to present. Here are two resources to help you start with the data room:

- A pre-seed data room example by Octopus Ventures

- Seed Data Room Template by Creandum

—

Superangel is an early-stage VC fund located in Tallinn, Estonia. We’re investing 300k-1M€ tickets into industry-defining technology companies in the Nordics and Baltics. We’re the backers of companies like Bolt, Veriff, Montonio, BOBW, and many more.