All successful billion dollar startups are obvious in hindsight. But how do you know in advance as a founder, how valuable your startup could become? Maybe it is not a billion dollar start-up, but is it a 100 million dollar start-up? We summarized some guidelines for startup founders to answer the startup potential question.

How can startup founders evaluate the true potential of their startup idea?

The Superangel team is reading the early bird applications of startups to our autumn cohort of Alpine House (application deadline 30th August). We are looking for global-minded early-stage software startups, who can truly take advantage of our Alpine House investment package on steroids, leap ahead and secure a Series A round in 12 months. A question about how big these startups can grow is very valid for us. While reading applications we see that some startups have missed some key points in describing their potential.

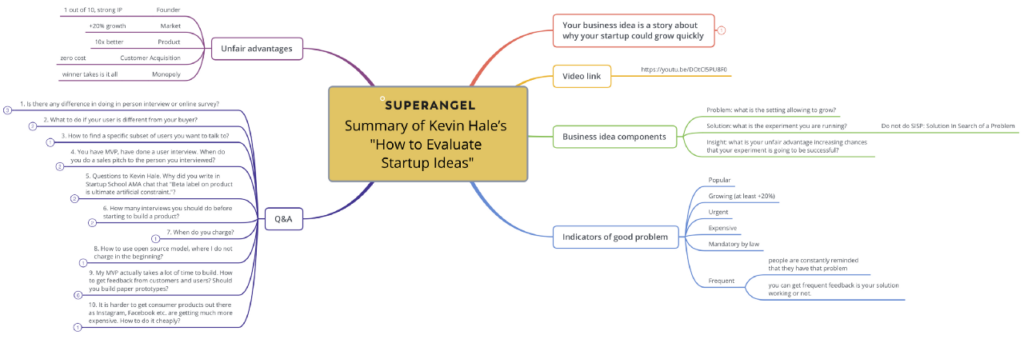

We looked around and found for founders some great advice in the public space. Kevin Hale and Eric Migicovsky last week at YC Startup School gave a good overview of how they suggest founders evaluate and validate their start-up ideas. As it resonates well with how we in Superangel look at startups, we took a shot and summarized their wisdom. To make your life easier, we even made mind maps out of their speeches (see below). If you want to get full mind maps with Kevin’s and Eric’s answers to questions in the Q&A session, go to the Superangel Facebook page, follow us and shoot us a FB Messenger request to get the pdf of Xmind files.

How to evaluate startup ideas?

The first message of Kevin Hale’s “How to Evaluate Startup Ideas” is that your business idea is a story about why your startup could grow quickly. It should be about growth and not about product features. As a side note, Kevin also gives a hint to founders for filtering great investors out from the ocean of VC funds and angels. All successful startups had a lot of holes in their original business idea. A good investor focuses first on finding ways how a startup founders story can become a billion-dollar company. Poking holes comes later.

As with every good story, your business idea should have specific components:

- Problem: what is the setting allowing you to grow?

- Solution: what is the experiment you are running?

- Insight: what is your unfair advantage increasing the chances that your experiment is going to be successful?

Kevin lists six criteria for a good problem. The more your startup idea has them, the better:

- Popular

- Growing (at least +20%)

- Urgent

- Expensive

- Mandatory (by law)

- Frequent

Frequency is probably the most important criteria as it gives two advantages: people are constantly reminded that they have that problem and you can get frequent feedback is your solution working or not.

Nailing a problem is hard, but nailing unfair advantage is equally hard. Kevin verbalizes five unfair advantages a startup can have:

- Founder: you are one of 10 people in the world capable of solving it or you have strong IP

- Market: at least +20% growth

- Product: 10x better than alternatives

- Customer Acquisition: zero cost to acquire the next customer

- Monopoly: you are the winner taking it all

Founder and Market advantage are the trickiest out of this list.

Although Kevin claims that 99% of startups coming to YC do not have founder advantage even YC has invested into startups purely based on the founding team, who did not have founder advantages. The most famous of such investments was Airbnb, who did not have a product YC believed in nor strong founder advantage in the form of a unique capability or IP. But they had grit, resourcefulness, and some traction, which outweighed the holes in their original business idea.

At Superangel we are looking for founder team advantage in the form of the 3Hs and honey badger attitude. Rei Inamoto coined the 3H description of a dream team: hipster, hustler and hacker. Great teams have these domains covered by different people. In Superangel we also evaluate if founders are like honey badgers, who can survive anything (like snake bites) and are willing to go against much larger predators (like lions) to get their food. That said, if your only advantage is your claim that you are a honey badger, you are probably not investment ready.

Same goes with market advantage. A great market is crucial. Taking from an interview with Andy Rachleff a lousy team on growing markets wins over a great team on lousy markets, and remarkable things happen only with great teams on great markets. That said, having only a market advantage is a weak starting point as it is not sustainable in the long term, and if it remains the only advantage, competition will kick you out from the market soon enough.

How can user interviews increase the value of your startup?

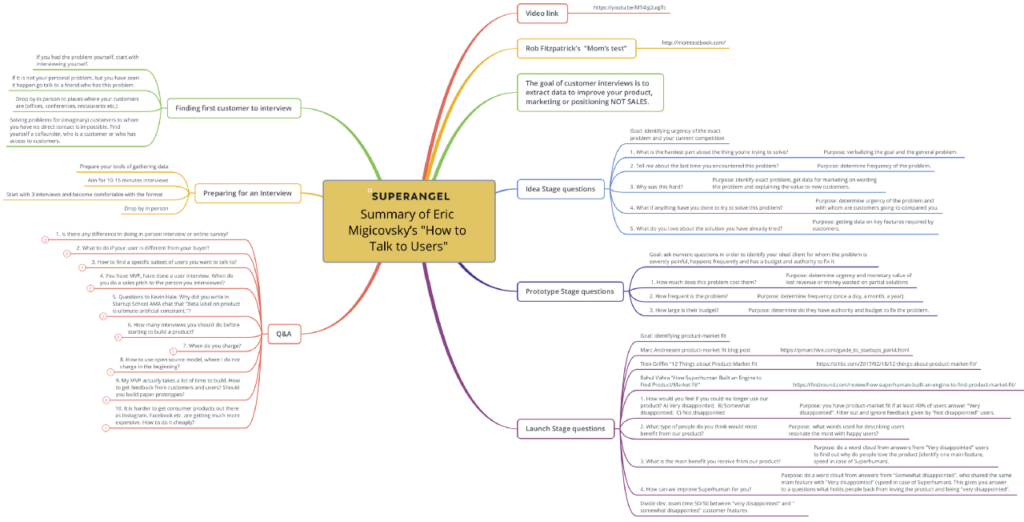

No matter with which story or set of advantages you start with, there is no way around talking to users if you want to grow. Eric Migicovsky puts it nicely in his “How to Talk to Users” speech: the best companies are the ones where founders maintain a direct connection with their users. Talking to users is the only way to know – for a fact – if you are building a billion-dollar company or not.

Like Eric, we also suggest startup founders read Rob Fitzpatrick’s “Mom’s test” for getting a grip on how to get valuable information out of customers.

The most important lesson to learn is about the goal of customer interviews. The goal of customer interviews is to extract data to improve your product, marketing or positioning. Although all good sales reps use a very similar process, user interviews are not about selling. Period.

During a good customer interview, you do not talk about your current idea, do not talk about your ideas on hypothetical future product features, and spend most of your time listening to your customer.

The questions you should ask vary depending on the stage your startup is in.

In the Idea Stage you should ask questions to identify the urgency of the exact problem and your current competition:

1.What is the hardest part about the thing you’re trying to solve? Purpose: verbalizing the goal and general problem.

2. Tell me about the last time you encountered this problem? Purpose: determine the frequency of the problem.

3. Why was this hard? Purpose: identify the exact problem, get data for marketing on wording the problem and explaining the value to new customers.

4. What if anything have you done to try to solve this problem? Purpose: determine the urgency of the problem and with whom your customers are going to compare you to.

5. What do you love about the solution you have already tried? Purpose: getting data on the key features required by customers.

In the Prototype Stage you should ask numeric questions in order to identify your ideal client for whom the problem is severely painful, happens frequently and has a budget and authority to fix it:

- How much does this problem cost them? Purpose: determine urgency and monetary value of lost revenue or money wasted on partial solutions.

- How frequent is the problem? Purpose: determine the frequency (once a day, a month, a year).

- How large is their budget? Purpose: to determine if they have the authority and budget to fix the problem.

In the Launch Stage you should ask questions to identify the product-market fit. One of the most famous blog posts about product-market fit comes from Marc Andreesen, where he claims that product-market fit is the only thing that matters and you have it when customers are pulling the product off the shelves. Tren Griffin has added more angles to product-market fit in his “12 Things about Product-Market fit”. Although both are highly recommended reads, they are retrospective and give lagging definitions on product-market fit. For a founder, it is very disappointing as before a launch you cannot measure nor improve your level of product-market fit.

This frustration led Rahul Vohra, CEO of Superhuman, to develop a process for measuring and improving your product-market fit BEFORE launch. You can read about his process and journey in a blog post “How Superhuman Built an Engine to Find Product/Market Fit”. Superhuman uses four questions for validating product-market fit:

- How would you feel if you could no longer use our product? A) Very disappointed; B) Somewhat disappointed; C) Not disappointed. Purpose: you have product-market fit if at least 40% of users answer “Very disappointed”. Filter out and ignore feedback given by “Not disappointed” users.

- What type of people do you think would most benefit from our product? Purpose: what words used for describing users resonate the most with happy users?

- What is the main benefit you receive from our product? Purpose: do a word cloud from answers from “Very disappointed” users to find out why people love the product (identify one main feature, speed in the case of Superhuman).

- How can we improve Superhuman for you? Purpose: do a word cloud from answers from “Somewhat disappointed”, who shared the same main feature with “Very disappointed” (speed in the case of Superhuman). This gives you the answer to a question what holds people back from loving the product and being “very disappointed”.

The startup Superhuman uses data from these four questions to determine how to divide the time of their product development team. Half of the time goes into developing further the main features “very disappointed” people love and the rest is spent on developing the main features holding back “somewhat disappointed” customers.

Preparing for user interviews

You know the purpose of a customer interview, you have the right questions. Now what? Here are some preparation tips:

- Prepare your tools for gathering data. If you are lousy at interviewing and taking notes simultaneously either get permission from customers to record the interview or ask a co-founder or a friend to come and take notes for you.

- Aim for 10–15 minutes interviews. You can get the most important data out from customers and show that you value their time.

- Start with 3 interviews and become comfortable with the format. If you have never done customer interviews before, take it casually. You do not have to start with a 7-day plan for 100 interview slots. Start with 3 interviews, reflect on how did it go and decide then on your next steps and interviews.

- Drop by in person. Sometimes it is difficult to get appointments arranged over e-mail or phone. Choose the least busy time for your customers and drop by in person at their workplace, conference booth or during their lunch break in a restaurant. If your product is any good at solving customer problems you are doing them a favour by asking 15 minutes of their time to solve their problems forever.

Startup founders in the idea phase often ask, where do I find my first potential customer for an interview? If you had the problem yourself, start with interviewing yourself. This is a great way of testing how you might need to modify questions so that they are more natural and easier to answer.

If it is not your personal problem, but you have seen it happen, go talk to a friend who has this problem.

As suggested above, drop by to places where customers are (firefighters in fire stations, etc).

If you do not have that problem and nobody in your close network has that problem, then you have a major problem. Solving problems for (imaginary) customers to whom you have no direct contact is impossible. Find yourself a co-founder, who is a customer or who has access to customers.

In the Q&A session Kevin and Eric were asked the following questions:

- Is there any difference in doing an in-person interview or online survey?

- What to do if your user is different from your buyer?

- How to find a specific subset of users you want to talk to?

- You have MVP, have done a user interview. When do you do a sales pitch to the person you interviewed?

- Questions to Kevin Hale. Why did you write in a Startup School AMA chat that “A beta label on a product is an ultimate artificial constraint.”?

- How many interviews should you do before starting to build a product?

- When do you charge?

- How to use an open-source model, where I do not charge in the beginning?

- My MVP actually takes a lot of time to build. How to get feedback from customers and users? Should you build paper prototypes?

- It is harder to get consumer products out there as Instagram, Facebook etc. are getting much more expensive. How to do it cheaply?

Watch the video to get their answers or go to Superangel’s Facebook page, follow us and shoot us a FB Messenger request to get the pdf or Xmind files with answers to these 10 questions.

If you are a software startup founder, who feels that you would benefit from strong hands-on support and from our investment package on steroids, then apply to Superangel’s Alpine House.